Designers

Simon Goh, Jomains Neo, Tiffany Teng, Neelam Thakur

Year

2024

Category

Concept

Country

Singapore

Design Studio / Department

Digital Experience Studio

Three questions to the project team

What was the particular challenge of the project from a UX point of view?

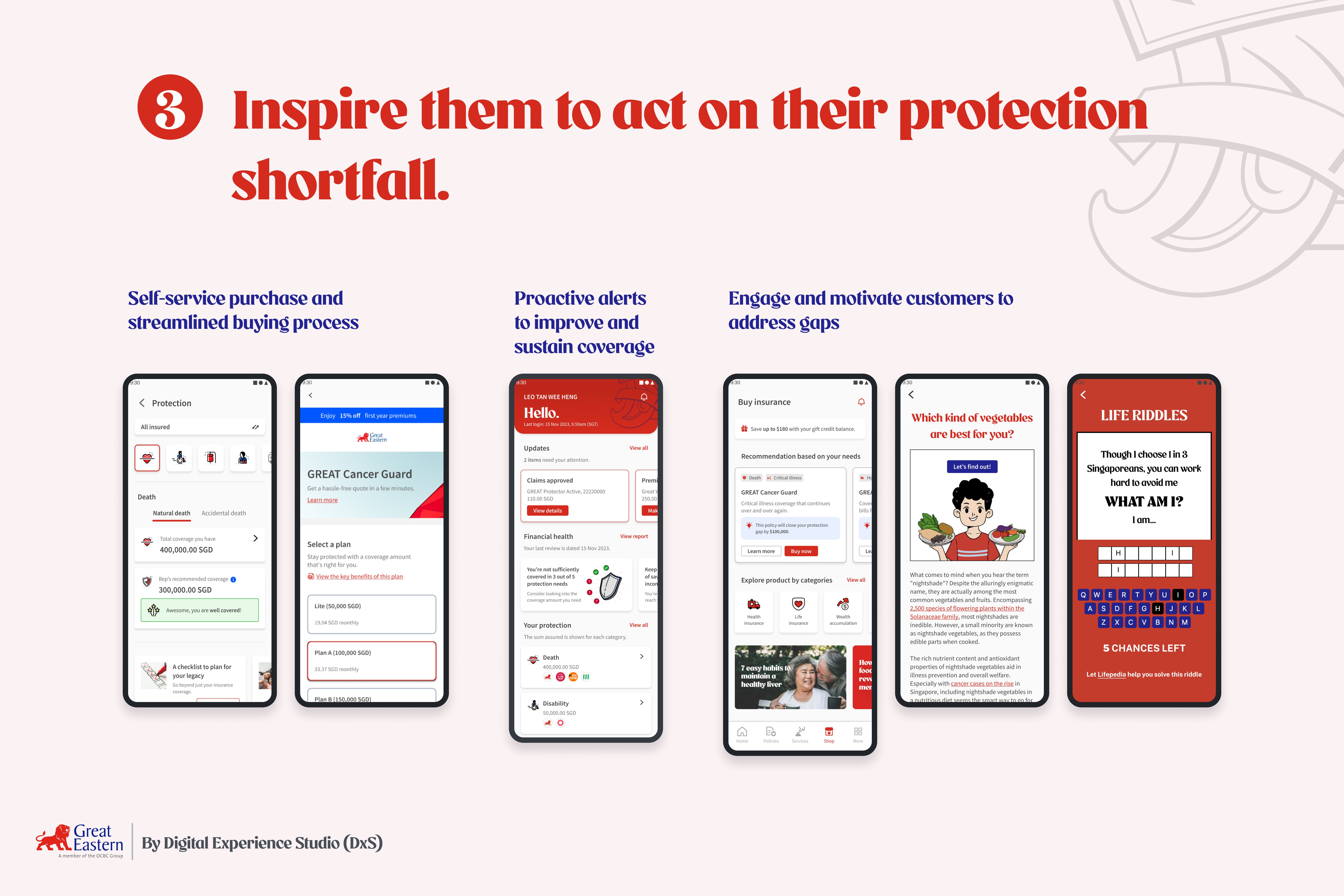

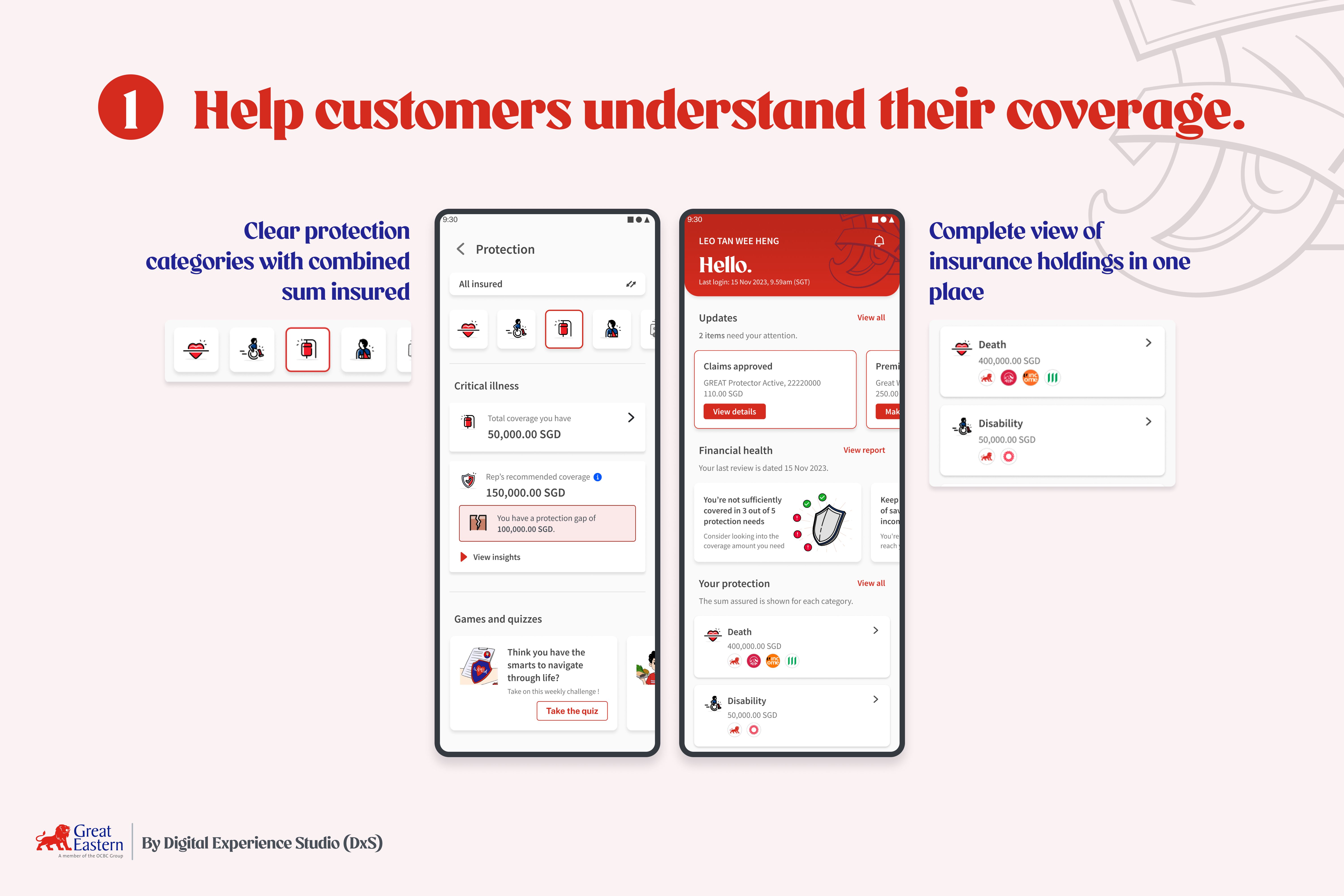

It's motivation. Despite being aware of insurance, most customers do not actively address their coverage gaps because insurance is hard to understand, and they seldom interact with insurance. In addition, some customers distance themselves from their financial advisers to avoid sales and the disclosure of personal financial data. The UX challenge is making insurance straightforward to understand and providing meaningful interactions so that they progress in necessary coverage. As a result, customers should want to use insurance to effectively achieve long-term financial comfort and meet their financial goals for themselves and their loved ones.

What was your personal highlight in the development process? Was there an aha!-moment, was there a low point?

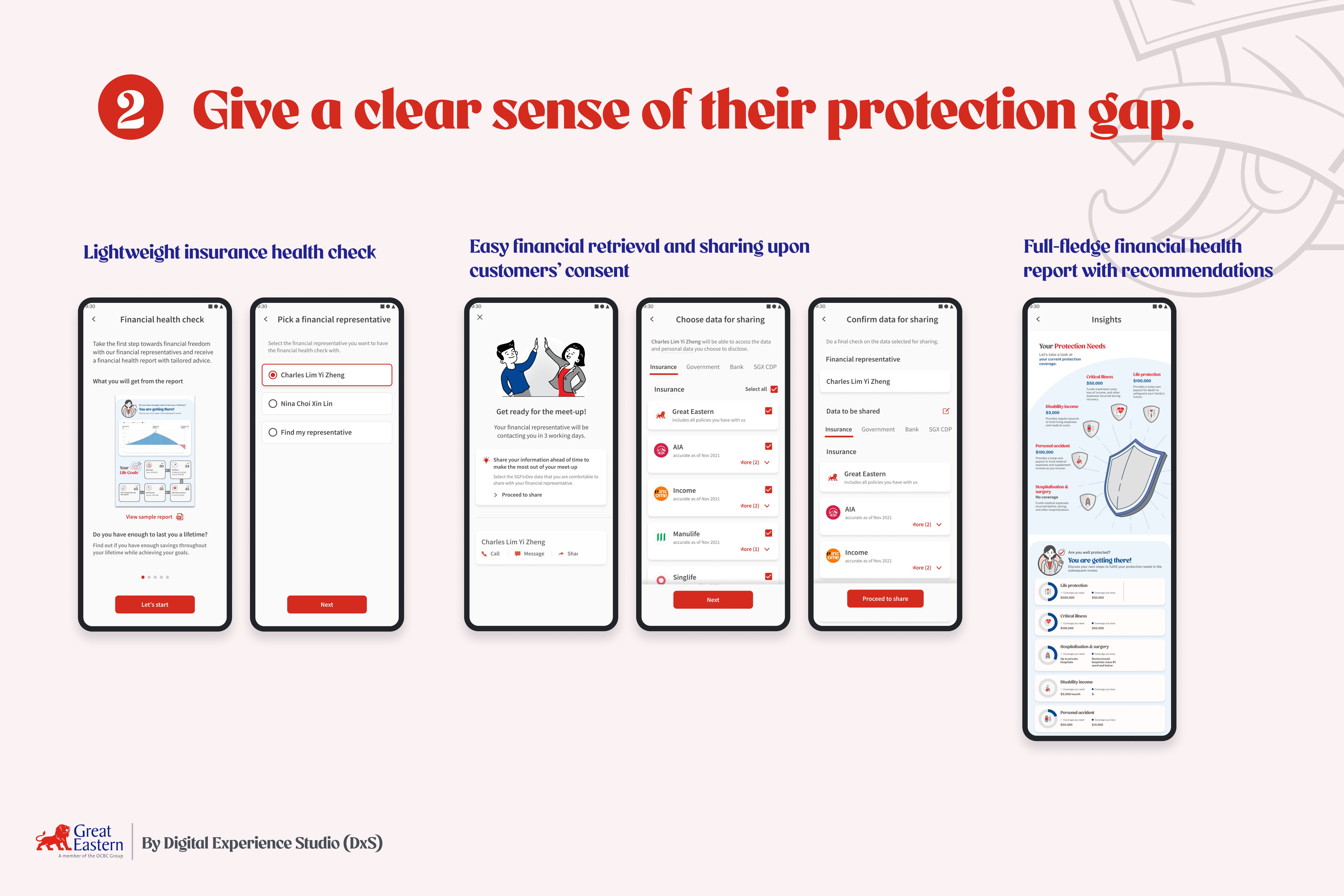

We came to realize customers often do not know what insurance they own. They bought various insurance plans over time with multiple insurers. It's frustrating for them to be told they lack coverage when they can't validate their existing benefits. Helping customers understand their coverage is fundamental to them wanting more. We started telling customers what they have rather than what they don't have. The move helps develop trust and lets them discover benefits they did not know they had. We had a low point when stakeholders pushed back a proposal for intuitive insurance categorization because they had to develop and maintain the mapping for over 3,000 active plans. It took a lot of convincing before they finally accepted the proposal.

Where do you see yourself and the project in the next five years?

We will continue the build-test-learn cycle and make improvements against performance metrics. Personalization will improve in terms of relevance and the level of granularity. For instance, we'll right-size customers' coverage rather than upsize them. Right-sizing will entail analyzing their most recent insurance portfolio, highlighting protection gaps based on customers' needs and tailoring solutions to achieve their protection goals in real-time. Financial advisers would be hyper-aware of customers' financial planning activities so that they can proactively provide advice. Customers will have full knowledge of their coverage gaps and have meaningful conversations with their financial advisers to address their needs.